Simple. Transparent. Secure

Smart Banking Solutions for Modern Businesses

Streamline your business finances with fast, secure, and scalable digital banking solutions.

Streamline your business finances with fast, secure, and scalable digital banking solutions.

Paymanent streamlines your business payments, collections, and compliance through one secure, scalable platform.

Transactions processed monthly across India

MPayouts compared to traditional banking

Businesses using Paymanent for UPI collections and payouts

From startups to enterprises, Paymanent is powering fast, secure, and scalable financial journeys without hidden charges.

Discover a robust suite of Simplify payments, collections, and compliance with our secure and scalable banking infrastructure.

Link all your bank accounts in one place and manage your finances with real-time insights and automation.

Pay all your business bills from one dashboard with bulk payments, reminders, and GST-ready invoices.

Collect payments instantly using UPI links or QR codes with real-time tracking and seamless integration.

Turn your outlet into a mini ATM offering withdrawals, balance checks, and commission-based services.

Disburse funds instantly to anyone via UPI, IMPS, or NEFT with complete tracking and automation.

Book bus and flight tickets in real time and earn commissions—perfect for agents and businesses.

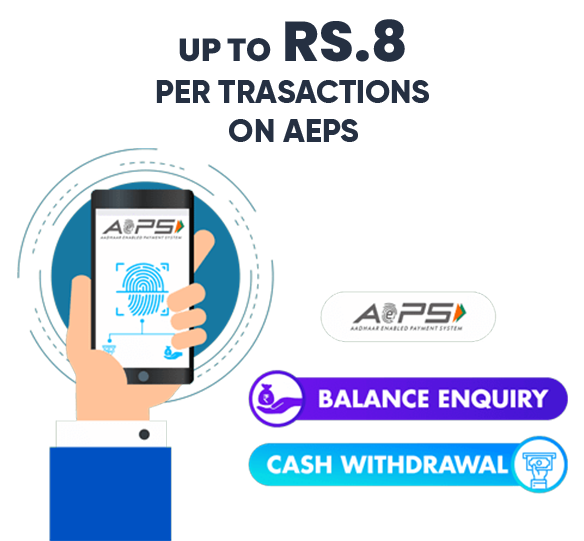

Offer AEPS services like withdrawals and balance checks using Aadhaar and biometric verification.

Verify PAN, Aadhaar, GST, bank accounts, and more instantly with secure, ready-to-use APIs.

From instant settlements to seamless API integrations, Paymanent gives your business the flexibility and control it needs to grow fast, secure, and scalable.

Simplify and automate financial operations with integrated digital banking tools.

Real-time, reliable collections and payouts across UPI, AEPS, and cards.

Book flights, hotels, and buses with ease through a unified platform.

Digital-first insurance solutions for fast and secure coverage.

Scalable APIs and services tailored to your business needs.

Seamlessly integrate KYC, Aadhaar, PAN, and other verification tools.

We've built Paymanent on security-first principles so every transaction, every API call, and every financial interaction is protected with military-grade encryption, multi-layer authentication, and real-time threat monitoring.

Paymanent gives you fast, flexible funding with no hidden fees designed to meet your business needs instantly.

Empowering Access. Simplifying Transactions.Paymanent’s AEPS solution delivers secure, Aadhaar-authenticated banking services—enabling seamless cash withdrawals, balance inquiries, and fund transfers without a debit card. Designed for reliability and reach, our platform redefines financial access with frictionless, real-time service tailored to evolving user needs.

Businesses Onboarded

APIs Integrated & Deployed

Banking Partners

Built for clarity, seamless integration, and agile growth, our modern API banking stack is engineered for unmatched reliability and effortless scalability.

Simple, clean, and easy to navigate

Zero disruption. Maximum reliability

End-to-end encrypted and fully compliant

Expert help available anytime you need

Integrate banking into your

application with our bundle of

flexible APIs used by thousands

of large businesses.

Super scalable cloud platform that auto-scales from zero to a million transactions, all in a single day.

Effortless banking and payment tools tailored for today's digital-first businesses. Whether you're a startup or an enterprise, we help streamline operations, reduce costs, and boost efficiency through our unified platform.

Get in touch with us, we'll help you build the right financial tools for your business, whether you're a startup, SME, or enterprise.

Get answers to all questions you have and boost your knowledge so you can save, invest and spend smarter. See all questions here!

You can open your account entirely online in just a few minutes. Provide your business details, verify KYC, and you're ready to go.

No, Paymanent offers transparent pricing with no hidden fees. All charges are clearly listed upfront before you proceed with any service.

We use end-to-end encryption, secure APIs, and follow strict compliance measures including RBI guidelines to protect your data and transactions.

Yes, our Instant Payouts service allows you to send money anytime—24×7—including weekends and holidays via UPI, IMPS, and more.

Our verification APIs for PAN, Aadhaar, GSTIN, and bank accounts can be integrated into your systems with simple API keys and documentation.

We provide connected banking, utility payments, UPI collection, micro ATM, instant payouts, Aadhaar banking, travel bookings, and verification APIs.

Not at all. Our platform is built with a user-friendly interface for non-tech users, and we offer developer APIs for businesses that want integrations.

Yes, our customer support team is available 24×7 to help with any queries or issues you may have.

Fill up the form and our team will get back to you within 24 hours

It only takes a few minutes to set up your FREE

Paymanent account and unlock powerful digital payment tools.

Get the latest updates via email. Any time you may unsubscribe

Copyright © 2025 All Rights Reserved by Payment | Designed by F6 IT Services Private Ltd

Loading